As a new mom, I am constantly looking for smart ways to empower my child’s future, especially, financially. As the saying goes, “you only reap what you sow” and the sooner you start sowing, the better. When it comes to investing in your child’s financial future, it doesn’t matter how little you invest, what matters most is starting early or at least making solid investment plans. Building a strong financial future for my child and future children is one thing my hubby and I take very seriously. To this end, we constantly research and seek professional advice on investment options and best money practices for our family. I have summarized below five strategic ways every parent can secure their child’s financial future. Given, every family is different and what works for family A may not work for family B, you just have to analyze your individual scenario and determine what financial moves would be wise to make considering your unique circumstance. Remember one wise financial move is better than none at all.

As a new mom, I am constantly looking for smart ways to empower my child’s future, especially, financially. As the saying goes, “you only reap what you sow” and the sooner you start sowing, the better. When it comes to investing in your child’s financial future, it doesn’t matter how little you invest, what matters most is starting early or at least making solid investment plans. Building a strong financial future for my child and future children is one thing my hubby and I take very seriously. To this end, we constantly research and seek professional advice on investment options and best money practices for our family. I have summarized below five strategic ways every parent can secure their child’s financial future. Given, every family is different and what works for family A may not work for family B, you just have to analyze your individual scenario and determine what financial moves would be wise to make considering your unique circumstance. Remember one wise financial move is better than none at all.

Invest in a College Fund

Education is the most important gift any parent can ever give their child but the cost of a university education will easily burn a hole in your pocket. Which is why investing in a college fund is the number one smart financial move to make. There are several options out there for college investment funds including mutual funds and 529 plans. Before selecting a college fund, seek professional advice to determine which options present a better rate of return and the level of risk associated with each option. Also, consider the tax advantages of a 529 plan. With college funds accruing over time, all you and your child have to worry about is getting into a good school and you may even be able to skip out on getting expensive student loans.

Buy a Life Insurance Policy

I personally believe that once you bring a child into this world, it’s only right to set up a life insurance policy that will take care of that child should something happen to you. Again, discuss with a life insurance broker and figure out whether a term or whole life policy is right for you. Life Insurance is something that people don’t really speak about, but it should be discussed even more. Not everyone knows about this, so it is always important to stay informed on anything that will benefit you and the future of your children. As well as speaking to a specialist broker, it is advised to check out sites like https://www.moneyexpert.com/life-insurance/, to help understand what you are getting yourself into and to ensure you are picking the right policy. You will have so much peace of mind knowing that your child’s needs will be met and money will be available to protect your estate when the need arises.

Refinance Your Mortgage

Right after college I got a job with a mortgage bank and worked as a loan specialist till I left for graduate school a year and a half later. One of the most important lessons I learned about mortgages is how much you can save in the long run if you choose a 15-year over a 30-year loan repayment option. Choosing a shorter term will save you a lot of money in interests and you will be debt free much sooner. Also, depending on how early you purchase your home, you could be mortgage free by the time your child/children are of college age. Which means more money will be available to support your child’s higher education. As expected, with a shorter term repayment option, you will have to pay a little more monthly but with a lower interest rate, the amount of money saved in the long-run will be huge. Can’t do a 15-year repayment option? Then try a 20-year option. Another smart repayment option is making biweekly payments instead of monthly payments.

Improve Your Credit Score

This particularly goes to American-based parents. As you should know, the higher your credit score, the lower the interest rate you’ll receive when making big purchases like cars or real estate. Lower interest rates translate to lower monthly payments and big savings which translate to more money in your pocket to take care of your child’s immediate and while investing in his/her future needs.

Invest in Emerging Markets

Emerging markets like Nigeria, South Africa and Kuwait present some of the best investment opportunities. These emerging markets have fast growing funds with huge gains that could help you build substantial wealth in just a few years. Remember as with any other investment, there’s some level of risk involved with investing in foreign markets.

Finally, as you make your plans, consider speaking with an investment advisor who can guide you on the right path to a bright financially future.

Disclaimer:

The writer does not claim to be an investment expert and only offers these tips based on personal research and knowledge gained through dealings with investment professionals.

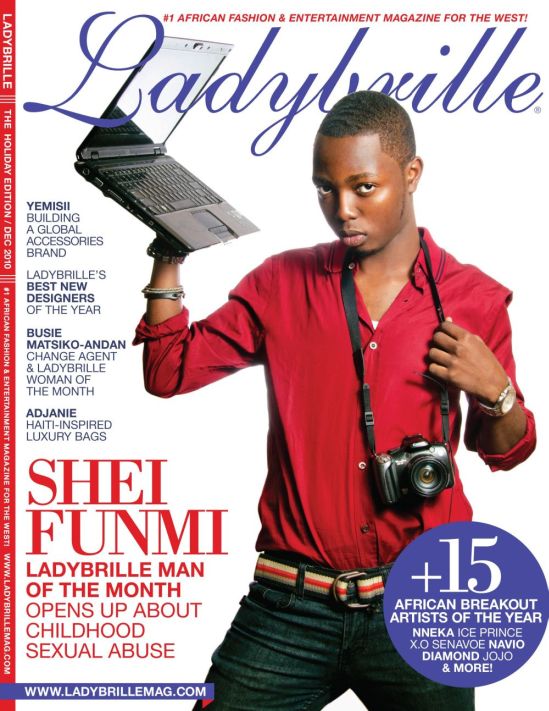

Founded in 2007, Ladybrille® Magazine is a California based pioneer digital publication demystifying the image of Africans in the west through contemporary African fashion and celebrating the brilliant woman in business and leadership, with an emphasis on the African woman in the diaspora. Our coverage includes stories on capital, access to markets, expertise, hiring and retention, sales, marketing, and promotions.