“It really scares me that people that I help, especially older people I help do not have any retirement savings. If you are not saving, you will be in trouble.” – Kim Allman

“It really scares me that people that I help, especially older people I help do not have any retirement savings. If you are not saving, you will be in trouble.” – Kim Allman

Hey you, yes you. How is your financial health? How do you feel about money? What word comes to mind when you hear “money”? Fear? Happiness? Insecurity? Have you ever been in debt? How much debt do you have? Are you feeling somewhat uncomfortable with our questions?

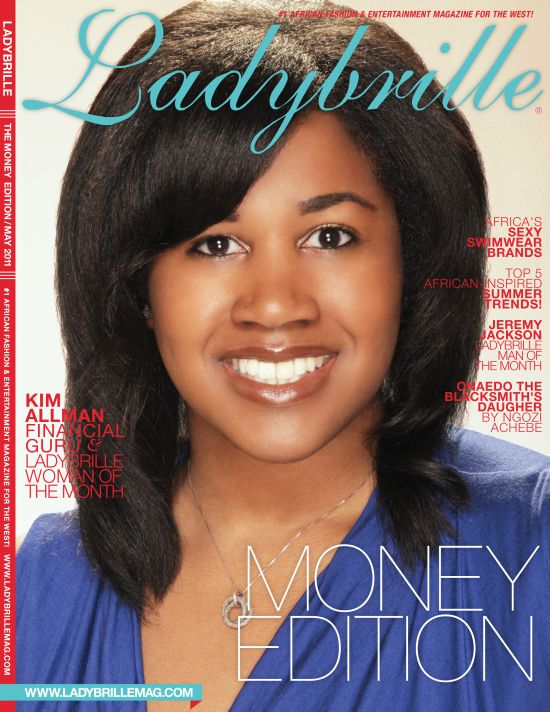

For our Ladybrille women, the powerful movers and shakers, and emerging successful entrepreneurs, how is your financial health? Financial health is not defined, per se, by your annual income but includes how much you are able to keep and save. While we certainly do not want you to get that personal on Ladybrille, we have enlisted the help of Kim Allman, a rising financial guru and our Ladybrille Woman of the Month for our May 2011 Money Edition, to discuss and share with us her insight on money and how the Ladybrille man and woman can have healthy attitudes towards money.

Allman, a Financial Consultant and President of Allman Financial Planning, LLC, began her career as a securities lawyer advising clients on a variety of investment products including hedge funds, mutual funds and real estate investment trusts. She received her AB in Psychology and Political Science from Duke University and received her JD with a concentration in Advocacy from Cornell University Law School. She also has a certificate in financial planning from Boston University. She serves on the board of the Optimum Institute of Economic Empowerment and is a member of the New York City Civil Court Housing Part Advisory Council. She is a member of the Financial Planning Association, the Association of the Bar of the City of New York and the Metropolitan Black Bar Association.

The Need For Financial Mentors

While many of us can point to great role models in our lives that taught us great life principles, many of us can barely point to financial role models. When we zoom in for a closer look at minority communities, the lack of financial mentors is really magnified. For Kim Allman, however, an African-American, she was fortunate to have her father be that great financial role model in her life. Allman grew up about an hour and a half from New York City in the suburbs with her father, mother and brother. Her father, now a retired engineer who worked for IBM throughout his career, showed the family the importance of money management at a very early stage. “We lived a comfortable middle class life,”explains Allman in her exclusive with Ladybrille Magazine. “There were certain things I watched my father do and the way he handled money that definitely had a big impact on me and the way I live my life today.”

Her father encouraged her to save. When she saved, he showed her how to invest what she had saved. “My father was helping me invest in an IRA Account when I was in high school. I think people don’t actually think about that. But, you can actually help your child invest, when they are that young, in an IRA as long as they have that kind of income. People do not think about that and it is important they do. It is important that they send the right message that it is really important to be thinking about finances and what things will look like in the future.

How did Mr. Allman know all these things about money? Who was his financial mentor? My father has always had this “intellectual curiosity” where he has always wanted to know about things. He wants to be responsible about what he does. I think my father taught himself a lot of these things,” explains Allman. “He would rather manage and not overspend, save his money, rather than live from paycheck to paycheck. I appreciate that because there are going to be a lot of young adults who will have to support their parents through retirement. I think my father looked and said, “I wanna make sure that I am not a burden on my children.””

Lucky for Allman, she inherited that behavior and characteristic from her father. “I went to Duke University and my parents realized back then that when you are giving a teenager a credit card, they have to understand the importance of taking that kind of commitment. And so, my freshman year at Duke, I got my first credit card and I had a part-time job, and I worked throughout college. So, I was able to buy things for myself. I paid for my spring break for myself, my school ring by myself. . . I think a lot of that came from my parents instilling in me that there was this joy that came from being able to take care of things by myself. To make my own money, buy things that I enjoy or needed and not run up this high credit card bills.”

So, how do we begin to incorporate and make better decisions about money? Allman offers the following six tips to help us get on our way to a stronger and healthier relationship with money and our personal finances:

1. Always Put Money Away for Yourself & Your Family: Allman cannot remember when her parents opened a bank account for her. She just always had one, at a very young age. “When people gave us gifts in cash form, for our birthdays etc, my parents would put that money away in our bank accounts for us,” explained Allman. “It wasn’t until both my brother and I were in our 20s my father was like, “hey, we have been saving all these money.” Her parents gave her the saved up monies when she was in law school. “It wasn’t a lot of money,” reflects Allman. “But it was enough to pay down part of my (school) loan, buy a new fridge etc.”

2. Borrow Wisely: Times have changed. We are in very difficult times. Isn’t Allman aware of it? Even Mr. & Mrs. Michelle and Barack Obama had barely finished paying their law school loans before they became President and First Lady respectively. What do the Ladybrille future executives and leaders who want to attend graduate school do? How should they borrow for school? Allman responds that if you are in high school en route to college or out of college en route to graduate school, you really need to think about your ultimate profession and how much it would cost for school. “People who are majoring in English Literature and taking out $150,000 loans, that is not very smart,” explained Allman. “They are not going to be able to use that major to pay off loans of that magnitude. Students have to really understand that they have to get a job that will help them pay back their student loans. Student loans are not dischargeable in bankruptcy. You have to realize that you will be stuck with the loans for the rest of your life. There is a necessary mind shift that must take place on how society and students view student loans. We have to get away from the idea that all student loans is good debt. Students have to really look at the possibility of how they will pay that debt down and think (through) whether that debt will be dragging them down for the rest of their lives.”

3. Spend Wisely: Many professionals, Allman explains, are finishing school and finding that the jobs they want are dried up. So, beyond borrowing wisely, they also have to be careful about how they spend. For Allman, she lived a frugal lifestyle, did not do anything extravagant while she was in graduate school. When she got extra money, she paid down some of the debt she borrowed while she was still in law school. “This becomes crucial because it is the difference with being able to leave my big firm, start my financial consulting and also work with a non-profit. A lot of people when I was leaving wanted to do the same and they said they wish [they] could do the same but they (couldn’t) afford it.” Enjoy your money but change your financial behavior for the future.

4. Don’t Be Afraid to Get Help: What if you followed all the financial rules out there but due to the bad economy, it has been tough for you to make ends meet. Now what? “What the economic crisis has taught us is that “life is not fair,” says Allman. “I work at a non-profit and I see people who did everything right. They had their savings, had a good mortgage but have fallen on hard times.” For those people, Allman says “do not give up hope.” There are many organizations available that will help. “People should not be ashamed to get help when they need them. Getting assistance is what keeps you afloat until you figure out what the next step. People also have to be creative during down times like these.” Being creative means starting a new business. “It has become easier to start a business. You can start an online business for next to nothing or nothing. So, really seek help and figure out if there is a better path for you.”

5. Get Educated About Money & Personal Finance: “Money is one thing we are not taught about in school,” says Allman. “I think money is one of those crucial things that everyone has to learn. There are resources and programs that can teach you about money. From adult training programs that cater to those who only have GEDs to more advance programs for the college educated,” explains Allman. “People need to invest in themselves to improve their ability to make more money.”

6. Track Your Spending: People should know “where their money is going,” says Allman. “Have you confronted your money demons?” is a question she says those who want to get financially healthy should ask and deal with. Be active and educate yourself. Ask yourself what is the best way for you to learn about money management and financial planning. Be willing to get professional help and realize that one size does not fit all. Figure out a plan that will work for you. For the wealthy among us, also track your spending because many wealthy people let money slip through their hands. Have an emergency savings plan, a financial plan and understand how you should be investing for each stage of life you transition into. Equally important, watch out for thieves!

-Uduak Oduok

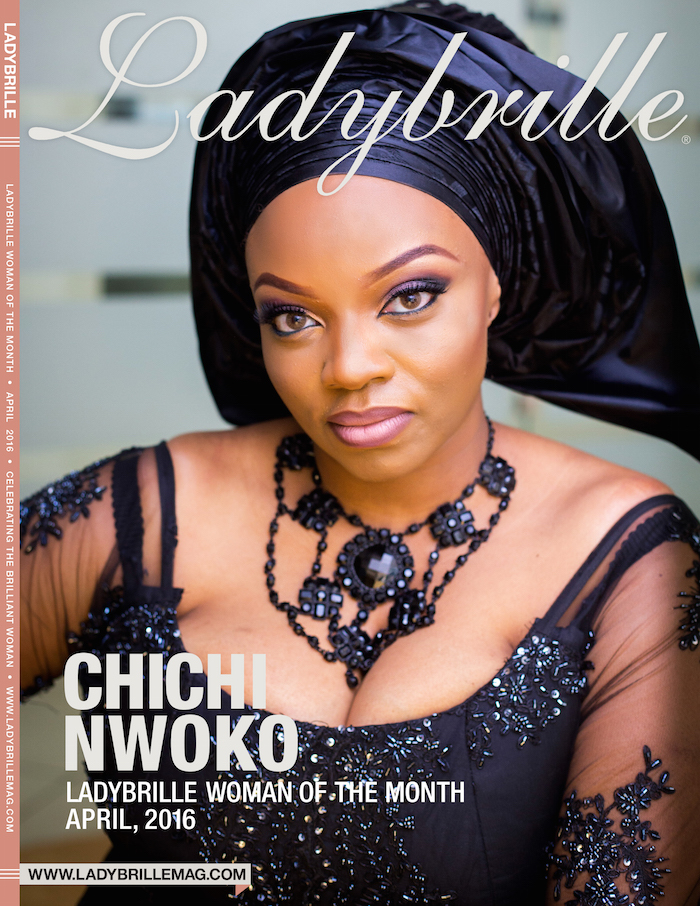

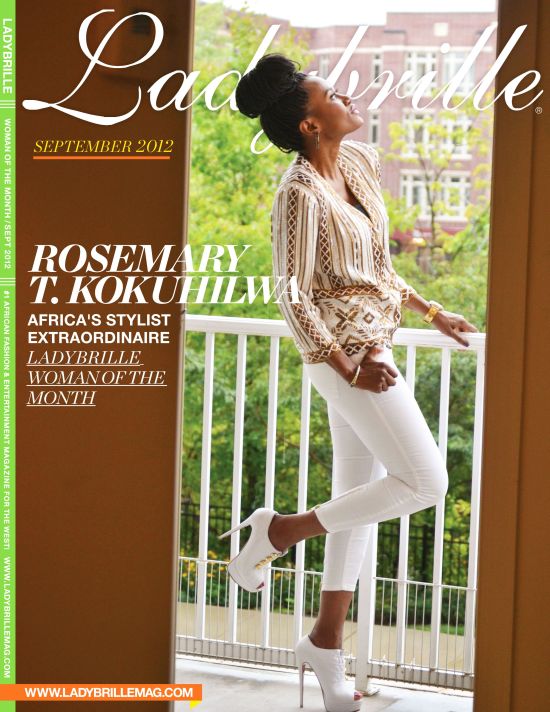

A running feature for 12 years on Ladybrille.com, The ‘Ladybrille Woman of the Month’ celebrates women in business and leadership, who empower themselves and others through their contributions and actions in their local and international communities. In 2014, the feature expanded to include a podcast show. If you would like to nominate a woman to be celebrated, please email [email protected].

Nice article, thanks for the information.